oklahoma franchise tax instructions

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma.

Seattle Teams Temporary Tattoos Seattleteamgear Com Temporary Tattoos Seattle Baby Oil

Scroll down the page until you find Oklahoma Annual Franchise Tax Return Form 200 Note that foreign non-profit corporations dont use Form 200.

. _____ -Office Use Only--Office Use Only-J. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Instead they use Form 200-N Foreign Not-For-Profit Corporation Annual. NOT have remitted the maximum amount of franchise tax for the preceding tax year. Complete Sections One and Three on pages 1 and 2.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Determine the amount of franchise tax due. These elections must be made by July 1.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. If filing a consolidated franchise tax return for oklahoma the oklahoma franchise tax for each corporation is computed separately.

Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a franchise tax return should. In Oklahoma the maximum amount of franchise tax a. Box 26930 Oklahoma City OK 73126-0930 Changes in Pre-Printed Information.

Oklahoma is classified as a non-registration state because it has no laws requiring franchisors to register with the state before offering or selling their franchise. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. The report and tax will be delinquent if not paid on or before September 15.

Lets say you own a cute little diner in tulsa that earns 500000 each year. Complete the applicable franchise tax schedules on pages 6-9. 71 801 et seq.

Start completing the fillable fields and carefully type in required information. Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Paper returns with a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. Eligible entities are required to annually remit the franchise tax.

If you checked Box Eindicate the changes only below. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form 512. Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO.

Submit separate Form 512 pages 6-9 for each company within the consolidation. A ten percent 10 penalty and one and one-fourth percent 125 interest per. Allocated or employed in Oklahoma.

To make this election file Form 200-F. Ad Find out what tax credits you qualify for and other tax savings opportunities. Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any attachments is true and correct to the best of my knowledge.

Oklahoma franchise tax instructions. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers.

To make this election file Form 200-F. But Oklahoma does have laws regulating the sale or offering of business opportunities under the Oklahoma Business Opportunity Sales Act Okla. Quick steps to complete and e-sign Oklahoma form 200 instructions 2021 online.

To file your Annual Franchise Tax by Mail. Form 200 - Page 5. Visit us at wwwtaxokgov to file your Franchise Tax Return Officer Listings Balance Sheets and Franchise Election Form Form 200-F.

Mine the amount of franchise tax due. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year. Get a personalized recommendation tailored to your state and industry.

The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed. Balance Sheet Date MMDDYY.

On the Oklahoma Tax Commission website go to the Business Forms page. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800. To make this election file Form 200-F. Use Get Form or simply click on the template preview to open it in the editor.

The franchise tax applies solely to corporations with capital of 201000 or more. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications.

Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or.

How To Organize Your Taxes With A Printable Tax Planner Direct Sales Planner Tax Organization Organization Planner Printables

Free Printable Personal Tax Checklist Tax Prep Checklist Filing Taxes Tax Checklist

Tips For Protecting Your Property From Squatters In Okc Business Management Real Estate Marketing Small Business Marketing

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

Http Www Anchor Tax Service Com Financial Tools Deductions Medical Deductions Medical Medical Dental Tax Services

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

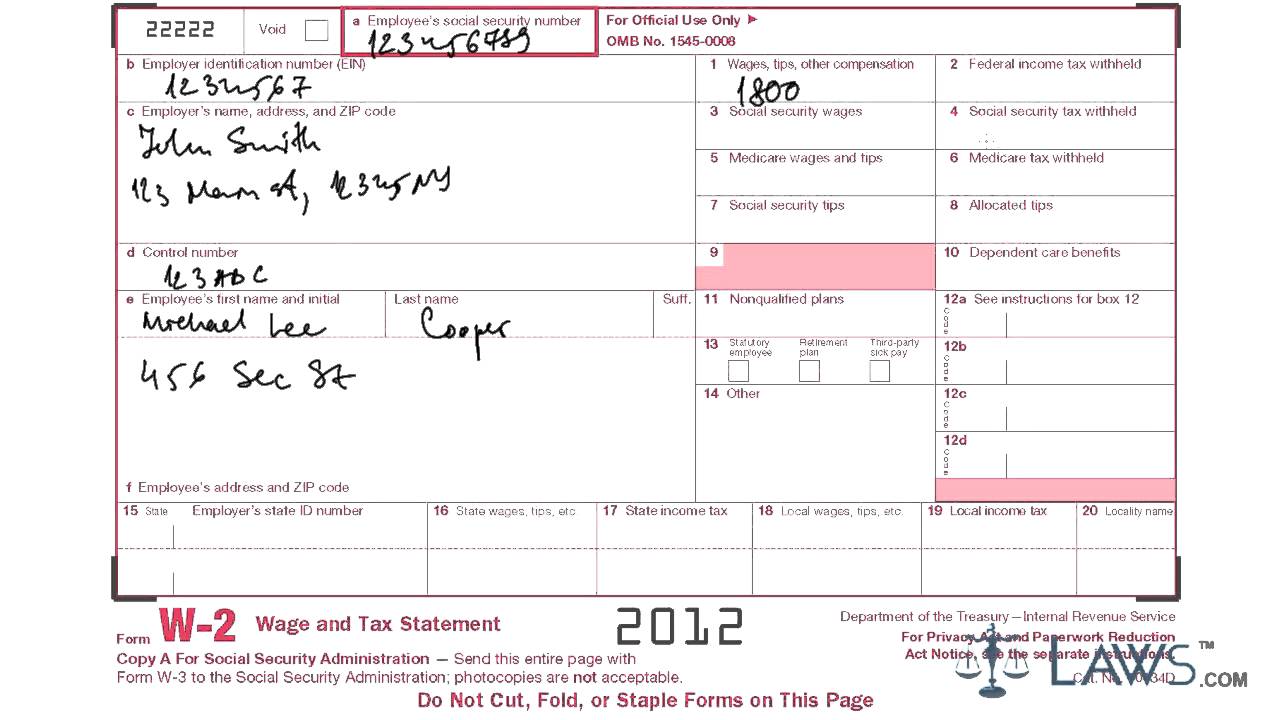

Learn How To Fill W 2 Tax Form Tax Forms Letter Example W2 Forms

Pin By Bianca Kim On W 2 Irs Tax Forms Internal Revenue Service Classroom Newsletter Template

Irs Partial Payment Installment Agreement Texas M Financial Consulting Inc Financial Blog Cleburne

What Is Tax And Taxation Really Napkin Finance Breaks It Down Investing Finance Investing Financial Literacy Lessons

Printable Tax Checklists Binder Organization Organization Organization Printables

Components Of Your Salary And Their Tax Benefits Infographic Employee Benefits Infographic Job Benefits Salary

Printable Tax Checklists Tax Printables Tax Checklist Small Business Tax

Tax Saving Investment Declaration To Employer How Does It Work Tax Saving Investment Investing Financial Management

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax